The net worth tab is strictly a spreadsheet for you to track your net worth on a monthly basis.

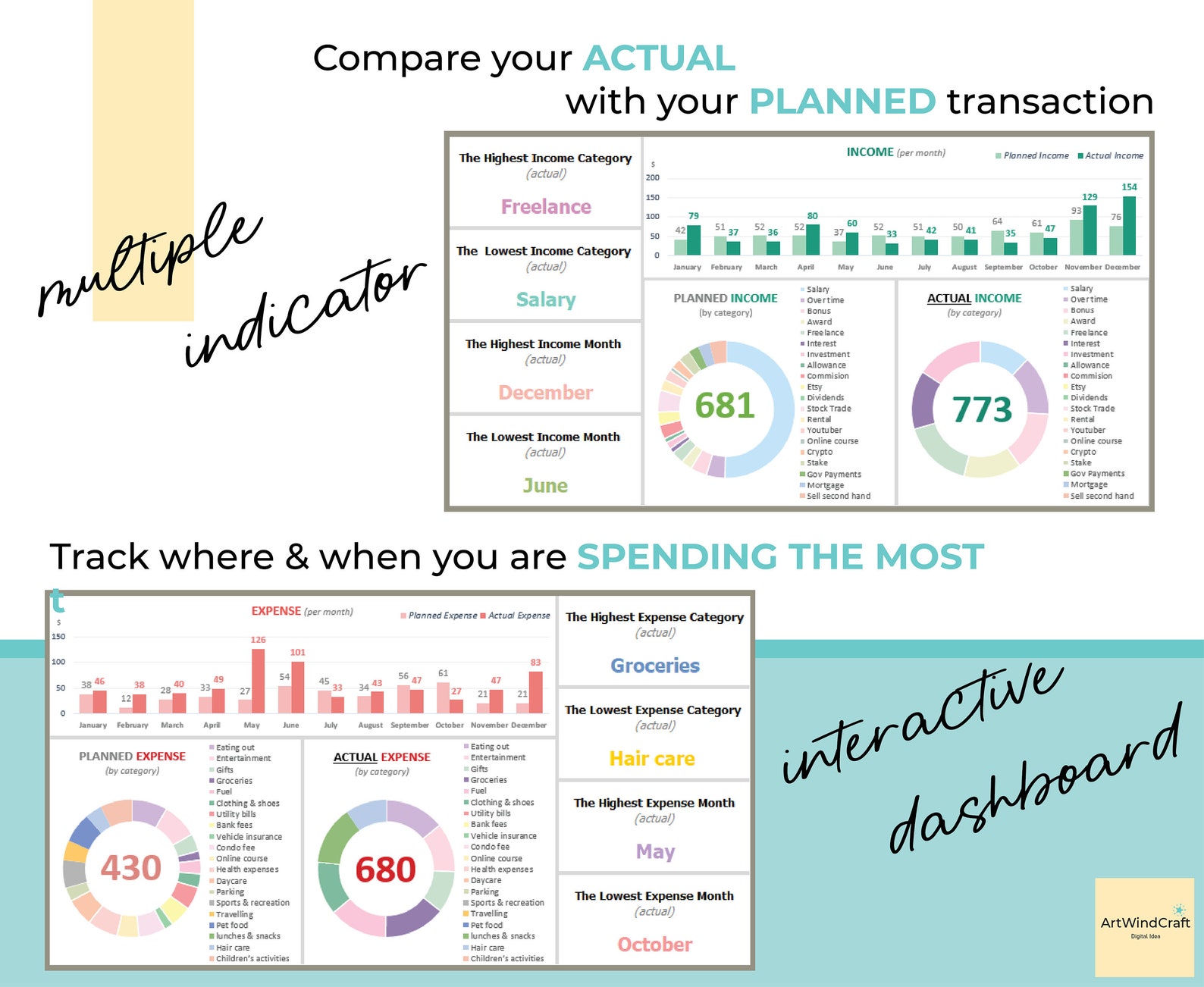

The budget tab will assist in making a strategy and providing you accountability on your progress. Lastly, I want you to be able to use the awareness you are gaining from understanding your expenses, to intentionally direct your money where you want it to go.If negative, are there ways I can increase my income or ways I can decrease my spending? If positive, should I be investing more? Pay off more debt? etc. Am I cash flow positive or negative every month.Are there areas I can be improving or expenses I could be cutting.What income is coming in on a monthly basis.What I want everyone to take away from the Cash Flow & January – December Tabs is a deep understanding of the following: It will show you how you have directed every dollar that came into your bank account into a bucket – an expense, an opportunity to save, invest or pay off debt. The goal with the Cash Flow template is to create more awareness and intention around your money coming in and where you choose to send money out. From there, your cash flow template and budget template will automatically be filled, providing you with a monthly overview and annual summary to better identify your inflows and outflows. In tabs January – December, you will be inputting the amount spent or the amount made and selecting one of the pre-determined categories.

The cash flow template is designed to provide you with a monthly and annual overview of your income, your spending, your saving, your investing and your debt payoff. Time and time again I hear the confusion of “where is my money going?” or “what am I even buying?” or “how is it that I breakeven every single month?”īut at that point, what change do we make? Are there expenses we could have done without? How much does that little expense really add up to over the course of a month? We don’t know and we won’t know unless we spend a little time tracking our expenses to get a better understanding. One of the foundational tools in building wealth and structure around our financial lives is by having a clear understanding of what money is coming in and where money is going out. Utilizing this Wealth Tracker will provide you with the level of control and understanding of your money that is required to effect positive change on your financial future.īelow I will provide you with a summary of each template – how it should be used and why it will help you going forward! We must first understand where we are before we can make changes and plans for where we want to go. The template is designed to build awareness around your current financial life & habits, hold you accountable for your financial goals, and identify the action steps required for you to build the financial life you want. Net Worth Template Cash Flow Template Budget Template Financial Goal Progress Report The template is broken down into the following: The FinPowered Female Personal Wealth Tracker is a 4-in-1 template encompassing all of the different areas that have a meaningful impact on our financial wellness and financial success. The difference between the total value of your assets and liabilities is your net worth.2022 is going to be the year we create intention with our finances and this Personal Wealth Tracker is going to make it so easy for you to do just that. Your liabilities, on the other hand, represent your debts, such as loans, mortgages, credit card debt, medical bills, and student loans. Intangibles such as your personal network are sometimes considered assets as well. Examples include investments, bank and brokerage accounts, retirement funds, real estate and personal property (vehicles, jewelry, and collectibles)-and, of course, cash itself. Your assets are anything of value that you own that can be converted into cash.

Regardless of your financial situation, knowing your net worth can help you evaluate your current financial status and plan for the future.

Liabilities include your mortgage, loans, credit card debt, student loans, and any other debt.Assets include investments, bank accounts, brokerage accounts, retirement funds, real estate, and personal items like your car or jewelry.Your net worth is the amount by which your assets exceed your liabilities, or what you have versus what you need to pay off.

0 kommentar(er)

0 kommentar(er)